Names of intelligence officials, agents, appear in Panama Papers

April 13, 2016 Leave a comment

The massive data leak of documents belonging to Panamanian law firm Mossack Fonseca has revealed the names of intelligence officials and agents form several countries, who employed front companies to conceal their financial activities. According to German newspaper Süddeutsche Zeitung, which was the initial recipient of the largest data leak in history last summer, the list of names includes intelligence officials from the Middle East, Latin America and Africa, as well as “close intermediaries of the [United States] Central Intelligence Agency”.

The massive data leak of documents belonging to Panamanian law firm Mossack Fonseca has revealed the names of intelligence officials and agents form several countries, who employed front companies to conceal their financial activities. According to German newspaper Süddeutsche Zeitung, which was the initial recipient of the largest data leak in history last summer, the list of names includes intelligence officials from the Middle East, Latin America and Africa, as well as “close intermediaries of the [United States] Central Intelligence Agency”.

Referred to as ‘the Panama Papers’, the massive leak amounts to over 11.5 million internal files from Mossack Fonseca, one of the world’s most prolific registrars and administrators of shell companies in offshore locations. Throughout its history, the company has created more than 300,000 shell companies, most of them in offshore tax havens like the British Virgin Islands, Cyprus, or Guernsey. Its clients are offered the ability to incorporate a generic-sounding company and headquarter it in an offshore tax haven. In exchange for an annual fee, Mossack Fonseca provides the company with a sham director and shareholders, thus concealing the true owner and actual beneficiary of the business.

The Süddeutsche Zeitung said on Monday that senior intelligence officials from Rwanda and Colombia are listed as Mossack Fonseca customers, but did not report the names of the individuals. It did, however, single out the late Sheikh Kamal Adham, who was director of Saudi Arabia’s General Intelligence Directorate in the 1960s and 1970s. During his 14-year directorship of the GID, the agency became a leading intermediary between the CIA and Arab intelligence agencies, notably those of Egypt and Iraq. Sheikh Adham was also a personal friend of CIA Director George Bush, who was later elected US president.

According to the Süddeutsche Zeitung, Sheikh Adham is one of many individuals with close CIA links whose names appear in the Panama Papers. Another is Farhad Azima, an Iranian-born American businessman, who is rumored to have leased aircraft to the CIA in the 1980s. The American intelligence agency is said to have used the aircraft, which belonged to Azima’s Kansas City, Missouri-headquartered Global International Airways, to transport weapons to Iran. The secret transfers were part of what later became known as the Iran-Contra scandal, in which US officials secretly sold weapons to Iran in return for the release of American hostages held by Iran-linked groups in the Middle East. The funds acquired from these weapons sales were then secretly funneled to the Contras, a medley of anti-communist paramilitary groups fighting the Sandinista-led government of Nicaragua.

► Author: Joseph Fitsanakis | Date: 13 April 2016 | Permalink

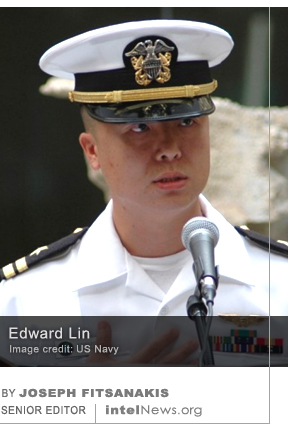

For the first time since 1985, when the Federal Bureau of Investigation broke the John Walker spy ring, an active United States Navy officer has been charged with espionage. On Sunday, the US Navy reported the arrest Lt. Cmdr. Edward C. Lin, who faces two counts of espionage and three counts of attempted espionage, among other charges. Aside from a three-page, heavily redacted

For the first time since 1985, when the Federal Bureau of Investigation broke the John Walker spy ring, an active United States Navy officer has been charged with espionage. On Sunday, the US Navy reported the arrest Lt. Cmdr. Edward C. Lin, who faces two counts of espionage and three counts of attempted espionage, among other charges. Aside from a three-page, heavily redacted  A senior official of Turkey’s state-run weapons manufacturer has been arrested on espionage charges, after he was caught selling weapons blueprints to the employee of an arms firm based in the United States. The official was named by Turkish authorities as Mustafa Tanriverdi, the general manager of one of Turkey’s largest weapons production facilities, located in the town of Kirikkale, 50 miles east of Turkish capital Ankara. Tanriverdi is reportedly employed by the Mechanical and Chemical Industry Corporation (MKE), a government-run manufacturing firm that provides much of the Turkish Armed Forces’ weaponry. The company also has a growing list of international buyers, which includes nearly 30 foreign governments.

A senior official of Turkey’s state-run weapons manufacturer has been arrested on espionage charges, after he was caught selling weapons blueprints to the employee of an arms firm based in the United States. The official was named by Turkish authorities as Mustafa Tanriverdi, the general manager of one of Turkey’s largest weapons production facilities, located in the town of Kirikkale, 50 miles east of Turkish capital Ankara. Tanriverdi is reportedly employed by the Mechanical and Chemical Industry Corporation (MKE), a government-run manufacturing firm that provides much of the Turkish Armed Forces’ weaponry. The company also has a growing list of international buyers, which includes nearly 30 foreign governments. A Romanian agency tasked with security and counterterrorism has announced the arrest of four Israeli citizens on charges of hacking the email accounts of Romanian government officials. The arrests were announced on Thursday by Daniel Horodniceanu, chief of Romania’s Directorate for the Investigation of Organized Crime and Terrorism, known as DIICOT). In a press statement, Horodniceanu said the Israeli citizens are all employees of Black Cube, an Israeli security firm that is known for hiring former members of Israel’s intelligence and and special forces agencies. Among the company’s most high-profile board members was Meir Dagan, the former director of Israel’s Mossad intelligence agency, who died in March after a long illness.

A Romanian agency tasked with security and counterterrorism has announced the arrest of four Israeli citizens on charges of hacking the email accounts of Romanian government officials. The arrests were announced on Thursday by Daniel Horodniceanu, chief of Romania’s Directorate for the Investigation of Organized Crime and Terrorism, known as DIICOT). In a press statement, Horodniceanu said the Israeli citizens are all employees of Black Cube, an Israeli security firm that is known for hiring former members of Israel’s intelligence and and special forces agencies. Among the company’s most high-profile board members was Meir Dagan, the former director of Israel’s Mossad intelligence agency, who died in March after a long illness. A videotaped lecture by Kim Philby, one of the Cold War’s most recognizable espionage figures, has been unearthed in the archives of the Stasi, the Ministry of State Security of the former East Germany. During the one-hour lecture, filmed in 1981, Philby addresses a select audience of Stasi operations officers and offers them advice on espionage, drawn from his own career. While working as a senior member of British intelligence, Harold Adrian Russell Philby, known as ‘Kim’ to his friends, spied on behalf of the Soviet NKVD and KGB from the early 1930s until 1963, when he secretly defected to the USSR from his home in Beirut, Lebanon. Philby’s defection sent ripples of shock across Western intelligence and is often seen as one of the most dramatic moments of the Cold War.

A videotaped lecture by Kim Philby, one of the Cold War’s most recognizable espionage figures, has been unearthed in the archives of the Stasi, the Ministry of State Security of the former East Germany. During the one-hour lecture, filmed in 1981, Philby addresses a select audience of Stasi operations officers and offers them advice on espionage, drawn from his own career. While working as a senior member of British intelligence, Harold Adrian Russell Philby, known as ‘Kim’ to his friends, spied on behalf of the Soviet NKVD and KGB from the early 1930s until 1963, when he secretly defected to the USSR from his home in Beirut, Lebanon. Philby’s defection sent ripples of shock across Western intelligence and is often seen as one of the most dramatic moments of the Cold War. Aside from their immediate shock value, the Panama Papers reveal the enormous extent of tax evasion on a worldwide scale. This unprecedented phenomenon is inextricably tied with broader trends in globalized finance-capitalism that directly threaten the very survival of the postwar welfare state. National intelligence agencies must begin to view offshore tax evasion as an existential threat to the security of organized government and need to augment their economic role as part of their overall mission to protect and secure law-abiding citizens.

Aside from their immediate shock value, the Panama Papers reveal the enormous extent of tax evasion on a worldwide scale. This unprecedented phenomenon is inextricably tied with broader trends in globalized finance-capitalism that directly threaten the very survival of the postwar welfare state. National intelligence agencies must begin to view offshore tax evasion as an existential threat to the security of organized government and need to augment their economic role as part of their overall mission to protect and secure law-abiding citizens. countries. On Sunday, following a year-long analysis of the data, the reporting partners began publishing revelations from the Panama Papers, and say they will continue to do so for several days to come.

countries. On Sunday, following a year-long analysis of the data, the reporting partners began publishing revelations from the Panama Papers, and say they will continue to do so for several days to come. statements, which means they have not been paying taxes in their country of citizenship or residency. Thus, there are now thousands of Mossack Fonseca clients in

statements, which means they have not been paying taxes in their country of citizenship or residency. Thus, there are now thousands of Mossack Fonseca clients in  The Russian government says it has arrested a senior Ukrainian intelligence officer, who was allegedly trained by the United States Central Intelligence Agency and tasked with infiltrating the Russian secret services. In a

The Russian government says it has arrested a senior Ukrainian intelligence officer, who was allegedly trained by the United States Central Intelligence Agency and tasked with infiltrating the Russian secret services. In a  The United States says a ship carrying hundreds of weapons, which was captured by the French Navy in the Indian Ocean, originated from Iran, and that the cargo was destined for Yemeni rebels through Somalia. The ship was seized on March 20 by a French warship patrolling the Indian Ocean as part of the Combined Maritime Forces (CMF). The CMF is a multinational naval fleet that aims to implement United Nations sanctions on Somalia. The sanctions are designed to frustrate the activities of al-Shabaab, an al-Qaeda-linked Somali militant group, and to put an end to maritime piracy in the Horn of Africa.

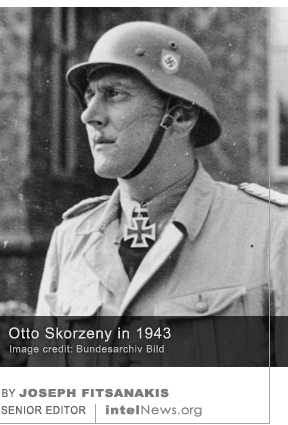

The United States says a ship carrying hundreds of weapons, which was captured by the French Navy in the Indian Ocean, originated from Iran, and that the cargo was destined for Yemeni rebels through Somalia. The ship was seized on March 20 by a French warship patrolling the Indian Ocean as part of the Combined Maritime Forces (CMF). The CMF is a multinational naval fleet that aims to implement United Nations sanctions on Somalia. The sanctions are designed to frustrate the activities of al-Shabaab, an al-Qaeda-linked Somali militant group, and to put an end to maritime piracy in the Horn of Africa. A notorious lieutenant colonel in the Waffen SS, who served in Adolf Hitler’s personal bodyguard unit, worked as a hitman for the Israeli intelligence agency Mossad after World War II, it has been revealed. Austrian-born Otto Skorzeny became known as the most ruthless special-forces commander in the Third Reich. Having joined the Austrian branch of the National Socialist German Workers’ Party at 19, at age 23 Skorzeny began serving in the Waffen SS, Nazi Germany’s conscript army that consisted largely of foreign-born fighters. In 1943, Hitler himself decorated Skorzeny with the Knight’s Cross of the Iron Cross, in recognition of his leadership in Operation EICHE, the rescue by German commandos of Italian fascist dictator Benito Mussolini, who had been imprisoned at a ski resort in the Apennine Mountains following a coup against his government.

A notorious lieutenant colonel in the Waffen SS, who served in Adolf Hitler’s personal bodyguard unit, worked as a hitman for the Israeli intelligence agency Mossad after World War II, it has been revealed. Austrian-born Otto Skorzeny became known as the most ruthless special-forces commander in the Third Reich. Having joined the Austrian branch of the National Socialist German Workers’ Party at 19, at age 23 Skorzeny began serving in the Waffen SS, Nazi Germany’s conscript army that consisted largely of foreign-born fighters. In 1943, Hitler himself decorated Skorzeny with the Knight’s Cross of the Iron Cross, in recognition of his leadership in Operation EICHE, the rescue by German commandos of Italian fascist dictator Benito Mussolini, who had been imprisoned at a ski resort in the Apennine Mountains following a coup against his government. The head of the United States’ largest intelligence agency secretly visited Israel last week, reportedly in order to explore forging closer ties between American and Israeli cyber intelligence experts. Israeli newspaper Ha’aretz

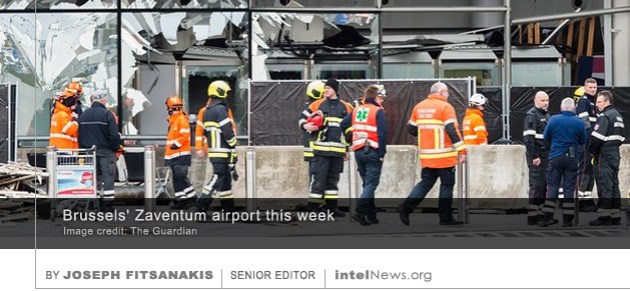

The head of the United States’ largest intelligence agency secretly visited Israel last week, reportedly in order to explore forging closer ties between American and Israeli cyber intelligence experts. Israeli newspaper Ha’aretz  In the past year, the Islamic State has claimed responsibility for at least nine terrorist attacks on foreign capitals. The growing list, which features Jakarta, Tunis, Paris, Beirut, Ankara, and Kuwait City, now includes the Belgian capital, Brussels. At least 34 people died in the attacks that rocked Brussels’ Zaventum airport and Maelbeek metro station on March 22, while another 300 were injured, 60 of them critically. This week’s bombings officially constitute the bloodiest terrorist attacks in Belgium’s history, prompting the country’s government to declare three days of national mourning.

In the past year, the Islamic State has claimed responsibility for at least nine terrorist attacks on foreign capitals. The growing list, which features Jakarta, Tunis, Paris, Beirut, Ankara, and Kuwait City, now includes the Belgian capital, Brussels. At least 34 people died in the attacks that rocked Brussels’ Zaventum airport and Maelbeek metro station on March 22, while another 300 were injured, 60 of them critically. This week’s bombings officially constitute the bloodiest terrorist attacks in Belgium’s history, prompting the country’s government to declare three days of national mourning. Belgian Intelligence Services ‘Overwhelmed and Outnumbered’

Belgian Intelligence Services ‘Overwhelmed and Outnumbered’ Meir Dagan, who directed the Israeli intelligence agency Mossad for a decade and emerged as a vocal critic of the Israeli government after his retirement, has died. A statement from his family said he died of liver cancer, a disease that prompted him to undergo a complex

Meir Dagan, who directed the Israeli intelligence agency Mossad for a decade and emerged as a vocal critic of the Israeli government after his retirement, has died. A statement from his family said he died of liver cancer, a disease that prompted him to undergo a complex  A court in Germany has sentenced a former officer of the country’s intelligence agency, who spied for the United States and Russia from 2008 to 2014. Regular readers of this website will recall the case of ‘Markus R.’, a clerk at the Bundesnachrichtendienst, or BND, Germany’s external intelligence agency. The 32-year-old was

A court in Germany has sentenced a former officer of the country’s intelligence agency, who spied for the United States and Russia from 2008 to 2014. Regular readers of this website will recall the case of ‘Markus R.’, a clerk at the Bundesnachrichtendienst, or BND, Germany’s external intelligence agency. The 32-year-old was

Further arrests in Edward Lin spy case ‘possible’, says US official

April 15, 2016 by Joseph Fitsanakis Leave a comment

On Thursday, longtime intelligence and security correspondent Jeff Stein wrote in Newsweek magazine that Lin appeared to have “scores of friends in sensitive places” in the US and Taiwan. That is not surprising, given that Lin served as the Congressional Liaison for the Assistant Secretary of the Navy, Financial Management and Comptroller, between 2012 and 2014. A cursory survey of Lin’s LinkedIn page, said Stein, shows endorsements by a senior commander at the US Naval Air Station at Guantanamo, Cuba, as well as the US Pacific Fleet’s senior intelligence analyst on Southeast Asia. Other endorsers include Congressional liaison officers for the US Navy, a Taiwanese military attaché, and a former official in Taiwan’s Ministry of Defense.

It is believed that Lin was arrested over eight months ago, but Stein says the investigation, which is being conducted jointly by the Naval Criminal Investigative Service and the Federal Bureau of Investigation is still underway. He quotes an unnamed “US official who asked for anonymity in exchange for discussing some details of the case” as saying that, given Lin’s extensive contacts in the US intelligence establishment, the possibility of further arrests in the case should not be ruled out. Lin is currently being held in the Naval Consolidated Brig in Chesapeake, Virginia.

► Author: Joseph Fitsanakis | Date: 15 April 2016 | Permalink

Filed under Expert news and commentary on intelligence, espionage, spies and spying Tagged with China, counterintelligence, Edward C. Lin, Edward Lin, espionage, Jeff Stein, LinkedIn, News, Taiwan, United States, US Navy