April 4, 2016

by Joseph Fitsanakis

Aside from their immediate shock value, the Panama Papers reveal the enormous extent of tax evasion on a worldwide scale. This unprecedented phenomenon is inextricably tied with broader trends in globalized finance-capitalism that directly threaten the very survival of the postwar welfare state. National intelligence agencies must begin to view offshore tax evasion as an existential threat to the security of organized government and need to augment their economic role as part of their overall mission to protect and secure law-abiding citizens.

Aside from their immediate shock value, the Panama Papers reveal the enormous extent of tax evasion on a worldwide scale. This unprecedented phenomenon is inextricably tied with broader trends in globalized finance-capitalism that directly threaten the very survival of the postwar welfare state. National intelligence agencies must begin to view offshore tax evasion as an existential threat to the security of organized government and need to augment their economic role as part of their overall mission to protect and secure law-abiding citizens.

THE BACKGROUND OF THE LEAK

The source of the Panama Papers leak —the largest in history— is apparently a single individual who contacted the widely respected German newspaper Süddeutsche Zeitung over a year ago. After receiving assurances that his or her anonymity would be safeguarded, the source proceeded to provide the paper with what eventually amounted to over 11.5 million files. They include company emails, banking transaction records, and files of clients that span the years 1977 to 2015. The source asked for no financial compensation or other form of reimbursement in return, saying only that he or she wanted to “make these crimes public”.

Faced with the largest data leak in recorded history, the Süddeutsche Zeitung reporters contacted the International Consortium of Investigative Journalists (ICIJ), which is the international arm of the Washington-based Center for Public Integrity. With ICIJ acting as an umbrella group, the German reporters were eventually joined by 370 journalists representing 100 news outlets from 76  countries. On Sunday, following a year-long analysis of the data, the reporting partners began publishing revelations from the Panama Papers, and say they will continue to do so for several days to come.

countries. On Sunday, following a year-long analysis of the data, the reporting partners began publishing revelations from the Panama Papers, and say they will continue to do so for several days to come.

THE ROLE OF MOSSACK FONSECA

The documents are from the internal records of Mossack Fonseca, a law firm headquartered in Panama City, Panama, with offices in 42 countries. The company is one of the world’s most prolific registrars and administrators of shell companies in offshore locations. It has created more than 300,000 shell companies throughout its history, most of them in offshore tax havens like the British Virgin Islands, Cyprus, or Guernsey. Its clients are offered the ability to incorporate a generic-sounding company and headquarter it in an offshore tax haven. In exchange for an annual fee, Mossack Fonseca provides the company with a sham director and shareholders, thus concealing the true owner and actual beneficiary of the business.

The power of the leaked documents is that they reveal the actual owners of 214,000 offshore shell companies managed by Mossack Fonseca. The long list of names includes dozens of current and former heads of state, as well as hundreds of politicians, public figures and celebrities. Many of these individuals have failed to declare their earnings from their shell companies in their annual tax  statements, which means they have not been paying taxes in their country of citizenship or residency. Thus, there are now thousands of Mossack Fonseca clients in over 100 countries who are preparing to face the legal consequences of tax evasion.

statements, which means they have not been paying taxes in their country of citizenship or residency. Thus, there are now thousands of Mossack Fonseca clients in over 100 countries who are preparing to face the legal consequences of tax evasion.

SECURITY IMPLICATIONS

Equally importantly, however, the leaked documents reveal that Mossack Fonseca’s clients appear to include at least 33 individuals and companies that are involved in organized crime or have close contacts with terrorist organizations. This sheds light on the increasingly disappearing line that once separated illicit activities such as tax avoidance and tax evasion, from money laundering, organized crime and terrorism. This phenomenon is assisted by unscrupulous companies like Mossack Fonseca, which act as anonymizing platforms for wealthy celebrities, criminals and terrorists alike.

The leak also shows the extent to which national governments have been unable to stem the tide of unfettered finance-capitalism, which today threatens the stability and cohesion of developed and developing economies alike. Moreover, the sheer scale of offshore capital funds, which, according to one expert, amount to as much as $32 trillion, threaten the economic security of nation states and must be viewed as an existential threat to the ability of states to fund public expenditures though taxation. The political arrangement that led to the creation of the postwar welfare state is today being directly threatened by the inability or unwillingness of organized states to monitor the largely unregulated flow of capital to offshore tax havens.

Today, entire economies, including much of southern Europe, the Balkans, as well as Latin America, are crumbling under the fiscal weight created by mass-scale tax evasion and organized crime. Organized criminals are now actively working closely with the banking sector, thus creating even more opportunities for money laundering and other financial illegality on an unprecedented scale. The Süddeutsche Zeitung revelations demonstrate that the line that separates legitimate economic activity from the rogue underbelly of global capitalism is exceedingly thin. It is high time that Western intelligence agencies viewed this worrying development as an asymmetrical threat against the security of law-abiding societies and began dealing with offshore tax havens with the same intensity that they have displayed against terrorist safe havens since 9/11.

► Author: Joseph Fitsanakis | Date: 04 April 2016 | Permalink

An intense fight between the United States and Russia over the extradition of a Russian cryptocurrency tycoon being held in Greece, is raising questions about the possible use of cryptocurrencies by spies. The tycoon in question is Aleksandr Vinnik, 39, who in 2011 co-founded BTC-e, an international cryptocurrency-trading platform. BTC-e allowed users to buy or sell several popular cryptocurrencies, including bitcoin and litecoin, using Russian rubles, United States dollars, or European Union euro currencies. Although headquartered in Russia, BTC-e’s servers were located in Bulgaria, while its operations were conducted through its offshore components in Cyprus and the Seychelles.

An intense fight between the United States and Russia over the extradition of a Russian cryptocurrency tycoon being held in Greece, is raising questions about the possible use of cryptocurrencies by spies. The tycoon in question is Aleksandr Vinnik, 39, who in 2011 co-founded BTC-e, an international cryptocurrency-trading platform. BTC-e allowed users to buy or sell several popular cryptocurrencies, including bitcoin and litecoin, using Russian rubles, United States dollars, or European Union euro currencies. Although headquartered in Russia, BTC-e’s servers were located in Bulgaria, while its operations were conducted through its offshore components in Cyprus and the Seychelles. The former chief executive of Danske Bank’s subsidiary in Estonia, which is implicated in a massive money laundering scheme, has been found dead in an apparent suicide in Tallinn. Aivar Rehe, 56, headed the Estonian subsidiary of the Copenhagen-based Danske Bank, one of Northern Europe’s largest retail banks, which was founded in 1871. He belonged to a group of dynamic young entrepreneurs who spearheaded the privatization of the Estonian economy in the post-Soviet era.

The former chief executive of Danske Bank’s subsidiary in Estonia, which is implicated in a massive money laundering scheme, has been found dead in an apparent suicide in Tallinn. Aivar Rehe, 56, headed the Estonian subsidiary of the Copenhagen-based Danske Bank, one of Northern Europe’s largest retail banks, which was founded in 1871. He belonged to a group of dynamic young entrepreneurs who spearheaded the privatization of the Estonian economy in the post-Soviet era. Brazilian police have announced the arrest of Assad Ahmad Barakat, a Lebanese national who is believed to be one of the most prolific international financiers for the Shiite group Hezbollah. Barakat was born in Lebanon but fled to Paraguay in the mid-1980s in the midst of Lebanon’s brutal civil war. He began an import-export business and eventually acquired Paraguayan citizenship. He gradually built a small business empire in Paraguay, which included engineering and construction, as well as transportation firms. Throughout that time, however, Barakat maintained strong connections with Hezbollah, the paramilitary group that has a strong following among Lebanon’s large Shiite Muslim community.

Brazilian police have announced the arrest of Assad Ahmad Barakat, a Lebanese national who is believed to be one of the most prolific international financiers for the Shiite group Hezbollah. Barakat was born in Lebanon but fled to Paraguay in the mid-1980s in the midst of Lebanon’s brutal civil war. He began an import-export business and eventually acquired Paraguayan citizenship. He gradually built a small business empire in Paraguay, which included engineering and construction, as well as transportation firms. Throughout that time, however, Barakat maintained strong connections with Hezbollah, the paramilitary group that has a strong following among Lebanon’s large Shiite Muslim community. An investigation by a consortium of European newspapers has uncovered details of a massive slush fund worth nearly $3 billion, which was allegedly used by Azerbaijan’s governing elite to bribe officials, business leaders and journalists at home and abroad. The fund was operated out of Baku, the capital of the former Soviet state, which is routinely accused of human-rights abuses. Western countries, including the United States,

An investigation by a consortium of European newspapers has uncovered details of a massive slush fund worth nearly $3 billion, which was allegedly used by Azerbaijan’s governing elite to bribe officials, business leaders and journalists at home and abroad. The fund was operated out of Baku, the capital of the former Soviet state, which is routinely accused of human-rights abuses. Western countries, including the United States,  The director of Nigeria’s powerful intelligence agency has been suspended on orders of the president, after a massive stash of cash totaling $43 million was found in an apartment in Lagos. The money was discovered by investigators working for the Nigerian Economic and Financial Crimes Commission (EFCC). Based in Abuja, the EFCC is a high-profile body that was created in 2003, in response to accusations by the international community that Nigeria is used as a major base for global money-laundering schemes.

The director of Nigeria’s powerful intelligence agency has been suspended on orders of the president, after a massive stash of cash totaling $43 million was found in an apartment in Lagos. The money was discovered by investigators working for the Nigerian Economic and Financial Crimes Commission (EFCC). Based in Abuja, the EFCC is a high-profile body that was created in 2003, in response to accusations by the international community that Nigeria is used as a major base for global money-laundering schemes. Aside from their immediate shock value, the Panama Papers reveal the enormous extent of tax evasion on a worldwide scale. This unprecedented phenomenon is inextricably tied with broader trends in globalized finance-capitalism that directly threaten the very survival of the postwar welfare state. National intelligence agencies must begin to view offshore tax evasion as an existential threat to the security of organized government and need to augment their economic role as part of their overall mission to protect and secure law-abiding citizens.

Aside from their immediate shock value, the Panama Papers reveal the enormous extent of tax evasion on a worldwide scale. This unprecedented phenomenon is inextricably tied with broader trends in globalized finance-capitalism that directly threaten the very survival of the postwar welfare state. National intelligence agencies must begin to view offshore tax evasion as an existential threat to the security of organized government and need to augment their economic role as part of their overall mission to protect and secure law-abiding citizens. countries. On Sunday, following a year-long analysis of the data, the reporting partners began publishing revelations from the Panama Papers, and say they will continue to do so for several days to come.

countries. On Sunday, following a year-long analysis of the data, the reporting partners began publishing revelations from the Panama Papers, and say they will continue to do so for several days to come. statements, which means they have not been paying taxes in their country of citizenship or residency. Thus, there are now thousands of Mossack Fonseca clients in

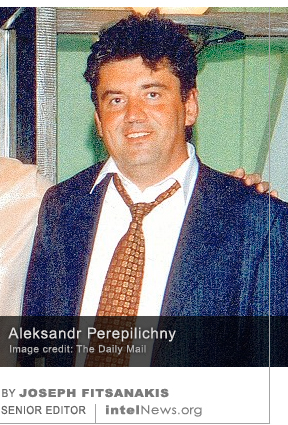

statements, which means they have not been paying taxes in their country of citizenship or residency. Thus, there are now thousands of Mossack Fonseca clients in  A Russian businessman, who died in London while assisting a Swiss probe into a massive money-laundering scheme, may have been poisoned with a substance derived from a highly toxic plant, an inquest has heard. Aleksandr Perepilichny was an influential Moscow investment banker until he fled Russia in 2009, saying that his life had been threatened after a disagreement with his business partners. A few months later, having moved to an exclusive district in Surrey, south of London, Perepilichny began cooperating with Swiss authorities who were investigating a multi-million dollar money-laundering scheme involving senior Russian government officials. The scheme, uncovered by a hedge fund firm called Hermitage Capital Management (CMP), and described by some as the biggest tax fraud in Russian history, defrauded the Russian Treasury of at least $240 million. The case made international

A Russian businessman, who died in London while assisting a Swiss probe into a massive money-laundering scheme, may have been poisoned with a substance derived from a highly toxic plant, an inquest has heard. Aleksandr Perepilichny was an influential Moscow investment banker until he fled Russia in 2009, saying that his life had been threatened after a disagreement with his business partners. A few months later, having moved to an exclusive district in Surrey, south of London, Perepilichny began cooperating with Swiss authorities who were investigating a multi-million dollar money-laundering scheme involving senior Russian government officials. The scheme, uncovered by a hedge fund firm called Hermitage Capital Management (CMP), and described by some as the biggest tax fraud in Russian history, defrauded the Russian Treasury of at least $240 million. The case made international