Germany’s celebrity spy Werner Mauss on trial for multi-million dollar tax evasion

September 19, 2017 Leave a comment

Germany’s most famous living spy is on trial this week for hiding assets totaling $50 million in offshore bank accounts. He claims the money was given to him by unspecified “Western intelligence agencies” for his services. Werner Mauss became widely known in 1997, when he was arrested in Colombia for using a forged passport. He had traveled to the Latin American country to secure the release of a German woman who had been kidnapped by leftist guerrillas. The Colombian authorities eventually released him, following heavy diplomatic pressure from the German government. But the German media began investigating his background, and it soon became apparent that he was working for the German Federal Intelligence Service.

Germany’s most famous living spy is on trial this week for hiding assets totaling $50 million in offshore bank accounts. He claims the money was given to him by unspecified “Western intelligence agencies” for his services. Werner Mauss became widely known in 1997, when he was arrested in Colombia for using a forged passport. He had traveled to the Latin American country to secure the release of a German woman who had been kidnapped by leftist guerrillas. The Colombian authorities eventually released him, following heavy diplomatic pressure from the German government. But the German media began investigating his background, and it soon became apparent that he was working for the German Federal Intelligence Service.

Following his unmasking in 1997, Mauss enjoyed celebrity status in Germany. Published accounts of his exploits claim that he was directly involved in neutralizing over 100 criminal gangs and that his work led to the capture of 2,000 criminals and spies. Mauss also claims to have helped prevent dangerous chemical substances from falling into the hands of terrorist groups, and that he stopped the Italian Mafia from killing Pope Benedict. Last year, however, Mauss saw his celebrity status diminish after the German government charged him with tax evasion. German prosecutors uncovered several overseas bank accounts belonging to him, which they said contained tens of millions of dollars in hidden income. They alleged that Mauss used the funds to finance a luxurious lifestyle centered on expensive overseas holidays, luxury cars, expensive gifts to women, as well as a private jet.

On Monday, the 77-year-old Mauss made his final plea in a lengthy court case concerning two of his off-shore accounts, located in UBS bank branches in the Bahamas and Luxembourg. The prosecution alleges that he failed to pay tax on assets totaling in excess of $50 million in the decade between 2002 and 2012 alone. Additionally, it is claimed that Mauss traveled from Germany to Luxembourg several times a year, to withdraw approximately $330,000 in cash per month from his secret accounts. But the accused former spy claims that the money was given to him by “Western intelligence agencies” in return for his services against international crime and terrorism, and that he should not have to pay taxes on it. In previous court appearances, he claimed that the money was not his, but belonged to various Western intelligence agencies and he simply used it to carry out intelligence operations.

The trial continues. If Mauss is convicted, he could spend nearly seven years in prison.

► Author: Ian Allen | Date: 19 September 2017 | Permalink

Germany has launched an unprecedented investigation into three officers of Switzerland’s intelligence agency on suspicion that they spied on German tax investigators who were probing the activities of Swiss banks. News of the investigation comes three months after authorities in Germany

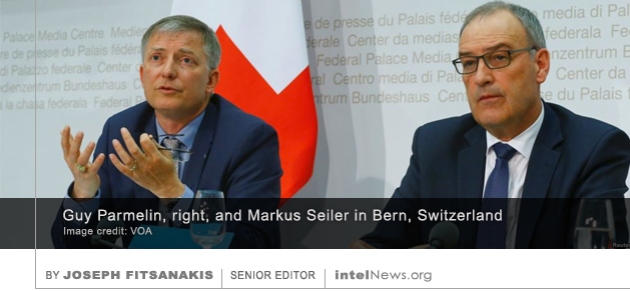

Germany has launched an unprecedented investigation into three officers of Switzerland’s intelligence agency on suspicion that they spied on German tax investigators who were probing the activities of Swiss banks. News of the investigation comes three months after authorities in Germany  Senior Swiss government officials, including the defense minister and the director of the country’s intelligence agency, have defended Switzerland’s right to spy on European tax-fraud investigators who meddle in Swiss affairs. Earlier this week, German authorities

Senior Swiss government officials, including the defense minister and the director of the country’s intelligence agency, have defended Switzerland’s right to spy on European tax-fraud investigators who meddle in Swiss affairs. Earlier this week, German authorities  Authorities in Germany have announced the arrest of a Swiss national who was allegedly spying on the activities of German tax-fraud investigators in Frankfurt. According to prosecutors in the German state of Hesse, of which Frankfurt is the largest city, the Swiss man was arrested on Friday and is currently in custody. He has been identified only as Daniel M., and is believed to be in his mid-50s. According to news reports, German counterintelligence officers had been monitoring the suspect for over a year. They were issued a warrant for his arrest in December of last year, but waited until he was on German soil to arrest him. He was arrested at Frankfurt Airport.

Authorities in Germany have announced the arrest of a Swiss national who was allegedly spying on the activities of German tax-fraud investigators in Frankfurt. According to prosecutors in the German state of Hesse, of which Frankfurt is the largest city, the Swiss man was arrested on Friday and is currently in custody. He has been identified only as Daniel M., and is believed to be in his mid-50s. According to news reports, German counterintelligence officers had been monitoring the suspect for over a year. They were issued a warrant for his arrest in December of last year, but waited until he was on German soil to arrest him. He was arrested at Frankfurt Airport. Aside from their immediate shock value, the Panama Papers reveal the enormous extent of tax evasion on a worldwide scale. This unprecedented phenomenon is inextricably tied with broader trends in globalized finance-capitalism that directly threaten the very survival of the postwar welfare state. National intelligence agencies must begin to view offshore tax evasion as an existential threat to the security of organized government and need to augment their economic role as part of their overall mission to protect and secure law-abiding citizens.

Aside from their immediate shock value, the Panama Papers reveal the enormous extent of tax evasion on a worldwide scale. This unprecedented phenomenon is inextricably tied with broader trends in globalized finance-capitalism that directly threaten the very survival of the postwar welfare state. National intelligence agencies must begin to view offshore tax evasion as an existential threat to the security of organized government and need to augment their economic role as part of their overall mission to protect and secure law-abiding citizens. countries. On Sunday, following a year-long analysis of the data, the reporting partners began publishing revelations from the Panama Papers, and say they will continue to do so for several days to come.

countries. On Sunday, following a year-long analysis of the data, the reporting partners began publishing revelations from the Panama Papers, and say they will continue to do so for several days to come. statements, which means they have not been paying taxes in their country of citizenship or residency. Thus, there are now thousands of Mossack Fonseca clients in

statements, which means they have not been paying taxes in their country of citizenship or residency. Thus, there are now thousands of Mossack Fonseca clients in

Germany drops espionage case against senior Swiss intelligence official

September 4, 2018 by Joseph Fitsanakis Leave a comment

The German government believes that billions of euros have been deposited by its citizens in banking institutions in European tax-havens like Liechtenstein, Switzerland or Monaco. For the past decade, German authorities have resorted to bribing whistleblowers in offshore banks in order to acquire internal documents that reveal the identities of German citizens who are hiding their money in foreign bank accounts. It is estimated that over a hundred million dollars have been paid to whistleblowers by German authorities since 2006. The latter argue that the proceeds collected from unpaid taxes and fines more than justify the payments made out to whistleblowers. But the Swiss government has strongly criticized Berlin for encouraging Swiss banking sector employees to steal internal corporate information that often breaks Switzerland’s stringent privacy laws. It is believed that the NDB has been instructed by the Swiss government to monitor efforts by German tax-fraud investigators to approach potential whistleblowers working in the Swiss banking sector.

The man identified as “Daniel M.” appears to be one of several Swiss spies who have been collecting information on the activities of German tax investigators. For a while it appeared that German counterintelligence officials were intent on targeting Paul Zinniker (pictured), Deputy Director of the NDB. They claimed that Zinniker was the main support officer of the operation that “Daniel M.” was participating in when he was arrested in Germany in 2017. According to the Germans, it was Zinniker’s who conceived the operation in 2011. But on Monday a spokesman for Germany’s federal prosecutor told the Swiss News Agency that Berlin dropped the case against Zinniker back in June. The revelation came less than 48 hours after a report in the Sunday edition of the Swiss newspaper Neue Zürcher Zeitung claimed that the charges against Zinniker would be dropped. According to the German federal prosecutor’s office, the case against the Swiss spy official was dropped because of the lack of cooperation by Swiss authorities, which made it impossible to prove that Zinniker was indeed the mastermind of the espionage operation against Berlin.

► Author: Joseph Fitsanakis | Date: 04 September 2018 | Permalink

Filed under Expert news and commentary on intelligence, espionage, spies and spying Tagged with Daniel M., economic intelligence, economics, espionage, Germany, NDB (Switzerland), News, Newstex, Paul Zinniker, Switzerland, tax evasion